Dive into the financial performance of Core Scientific as its shares fall 4% following the Q4 2023 results. Understand the factors contributing to this decline and its implications for investors.

The Bitcoin digger posted diminished YOY incomes for 2023 yet said restricting misfortunes and expanded interests in the framework are solid focuses heading into the Bitcoin dividing.

Crypto mining firm Center Logical (CORZ) detailed a fall in year-on-year incomes in its Q4 2023 outcomes and a huge decrease in overall deficits, with its portions falling 4% in night-time exchanging.

In a Walk 12 profit discharge, Center Logical said its last year’s complete income was $502.4 million, lessening $137.9 million from $640 million in 2022.

The yearly income drop came from the organization leaving the mining rig deals business and an expansion in the worldwide Bitcoin hash rate in 2023, it said.

Its final quarter 2023 net income was $141.9 million, an increment of $20.7 million from Q4 2022.

Moreover, the firm detailed a critical improvement in yearly overall deficits at just $246.5 million for 2023, down from an $2.14 billion overall deficit in 2022. In Q4 2023, overall deficits added up to $195.7 million, limiting from $434.9 million in Q4 2022.

Center Logical was relisted on the NASDAQ on Jan. 23 after rising out of a Chapter 11 emergency and a 13-month rebuilding cycle to determine $400 million underwater brought about by declining Bitcoin prices, rising energy costs, and debt tied to the bankrupt crypto lender Celsius.

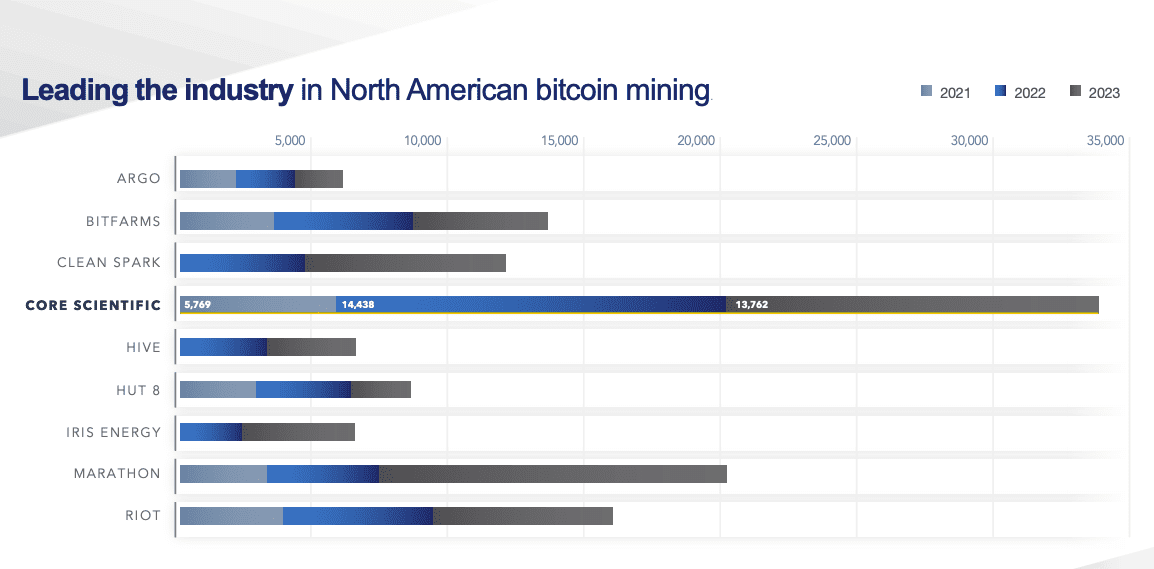

The biggest amount of BTC mined by any public mining firm in the US last year was revealed to be 13,762 BTC by the organization.

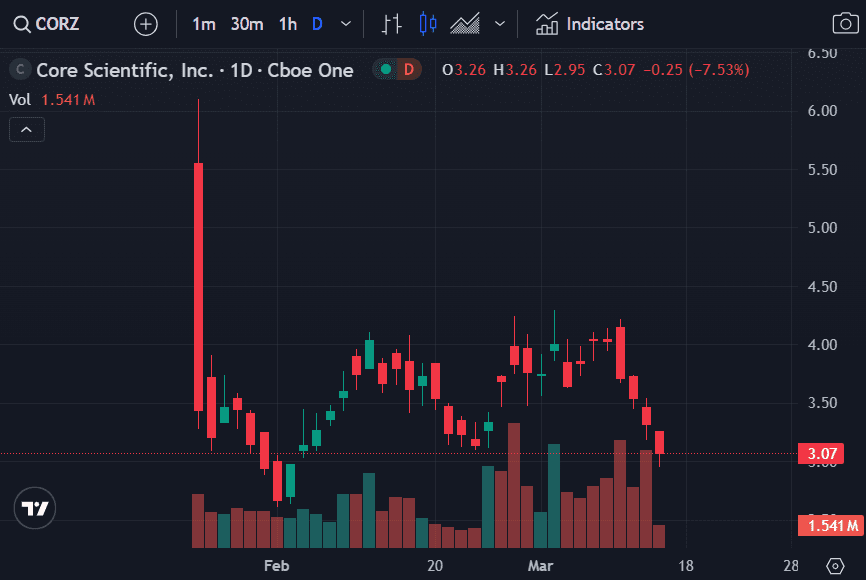

Core Scientific saw a nearly 4.6% drop on March 12, ending the day at $3.54 a share.

That drop went on in late night exchanging, falling an extra almost 4% to around $3.40, as per Tradingview.

CORZ saw a brief after-hours trading drop to just above $3 but quickly recovered. Source:TradingView

A spokesman for Marathon Patent Group, a public Bitcoin mining company, recently stated to Cointelegraph that the company is not too concerned about the lukewarm market reaction to its Q4 earnings.

The spokesman pointed out that the costs of mining Bitcoin have been reduced for public mining companies over the past few weeks. This comes as shares in Marathon Patent Group have fallen by 21% over the past month, while shares in rival mining company Riot Blockchain have dropped by 25% in the same period.

Bitcoin digger financial backers unfortunately of dividing

Blockware Arrangements’ head examiner Mitchell Cockeyed told Cointelegraph on Walk 1 that the “most legitimate” clarification at tumbling digger share costs came from financial backers becoming careful about conveying capital into the organizations before the Bitcoin splitting — an occasion that slices the prizes paid to excavators down the middle.

On Jan. 26, Cantor Fitzgerald delivered a report framing that few Bitcoin mining firms might battle to remain beneficial following the Bitcoin splitting. At the hour of the report, Bitcoin exchanged for generally $40,000.

At Bitcoin’s current price of $72,000, none of the firms listed in the report will be in the red following the halving — assuming no significant change in hash rate and that the price of Bitcoin holds above $62,000 after the halving slated for late April.

Center Logical’s representative guaranteed it was “strategically set up heading into the dividing,” adding it had been refreshing mining rigs with new Bitmain S21 models and was zeroing in on expanding its hash rate use as time went on.

A few experts have flipped bullish on Center Logical, mirroring a more extensive pattern of reestablished market hunger for crypto mining organizations following the radical increase in BTC and other digital currencies lately.

Capital market firm HC Wainright redesigned their rating of CORZ from “impartial” to “purchase” in a venture note on Jan. 25.

Venture banking research firm Compass Point likewise updated their CORZ rating from “nonpartisan” to “purchase” and set a value focus of $8.50 on Jan. 31, per MarketBeat information.

Read More.

Shiba Burn and O2T Token: A New Frontier for Crypto Adventurers?