Dive into Exchange Traded Funds (ETF)! This guide explores their types, benefits, risks, and investment strategies. Unlock diversification, low costs, and transparency to power your portfolio and reach your financial goals

Introduction

Essentially, exchange-traded funds (ETF) combine the best characteristics of two well-liked assets: They mix the ease of exchanging stocks with the diversification advantages of mutual funds.

What is an ETF?

An exchange-traded fund (ETF) is a grouping of securities like bonds or stocks. ETFs offer lower costs than other fund kinds and allow you to invest in a multitude of securities at once. Additionally, ETFs are easier to trade.

However, there isn’t a one-size-fits-all approach when it comes to ETFs or any other financial instrument. Consider them based only on their own merits, taking into account commission and management costs, simplicity of buying and selling, compatibility with your current portfolio, and quality of investment.

How do ETFs Work?

The fund provider owns the underlying assets. They create a fund to track the performance and provide investors with shares in that fund. An ETF’s assets are not owned by shareholders; rather, they own a portion of it.

Bulk dividend payments or reinvestments for the index’s member companies are possible for investors in an exchange-traded fund (ETF) that tracks a stock index.

Here’s a quick rundown of how ETFs work-

- An ETF provider creates a basket of assets, each with its own ticker, by taking into consideration the universe of assets, which may include stocks, bonds, currencies, or commodities.

- The same process used to purchase company stock can be used by investors to purchase a share in that basket.

- The ETF is traded on an exchange throughout the day by buyers and sellers, just like stocks.

Types of ETFs

Here are the different types of ETFs you can consider for your investment:

Equity ETFs:

- Track a basket of stocks, like an index fund.

- Offer diversification and low costs.

- Examples: SPDR S&P 500 ETF (SPY), iShares Core MSCI World ETF (IWorld).

Fixed-income ETFs:

- Invest in bonds, offering income and stability.

- Can be government, corporate, or high-yield bonds.

- Examples: iShares Barclays Aggregate Bond ETF (AGG), SPDR Bloomberg Barclays Global Aggregate Bond ETF (SPLG).

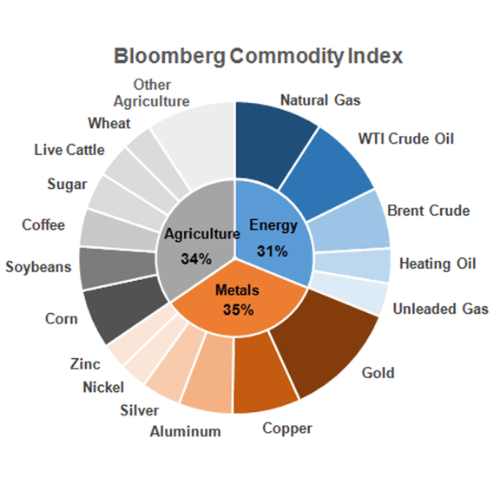

- Commodity ETFs:

- Track the price of commodities like gold, oil, or agriculture.

- Offer exposure to specific asset classes.

- Can be volatile, so invest cautiously.

- Examples: SPDR Gold Shares (GLD), iShares Silver Trust (SLV).

Sector ETFs:

- Invest in a specific sector of the economy, like technology or healthcare.

- Offer targeted exposure to growth areas.

- Can be more volatile than broad-based ETFs.

- Examples: Technology Select Sector SPDR Fund (XLK), Health Care Select Sector SPDR Fund (XLV).

International ETFs:

- Invest in stocks or bonds from other countries.

- Offer diversification and exposure to foreign markets.

- Can be subject to currency fluctuations.

- Examples: iShares MSCI Emerging Markets ETF (EEM), Vanguard FTSE Developed Markets ETF (VEA).

Smart Beta ETF:

- Track an index that uses alternative weighting methodologies.

- Aim to outperform traditional market-cap-weighted indexes.

- Can be more complex and less transparent than traditional ETF.

- Examples: iShares Edge MSCI Minimum Volatility USA ETF (USMV), PowerShares S&P MidCap Quality ETF (SPHQ).

Thematic ETF:

- Invest in companies based on a specific theme, like clean energy or robotics.

- Offer exposure to emerging trends.

- Can be even more niche and volatile than sector ETFs.

- Examples: iShares Global Clean Energy ETF (ICLN), and ARK Innovation ETF (ARKK).

Leveraged: These funds are designed to employ leverage to boost returns.

Most unlike ETF: which are designed to track an index, actively managed ETFs are aimed to outperform it.

- ETNs are debt securities guaranteed by the creditworthiness of the issuing bank that was established to enable access to illiquid markets; they also have the added advantage of generating virtually no short-term capital gains taxes.

- ETFs that let the investors trade volatility or get exposure to a specific investing strategy – such as currency carry or covered call writing, are examples of alternative investment ETFs

Style ETF: These funds are designed to mirror a specific investment style or market size focus, such as large-cap value or small-cap growth.

Inverse ETF: These funds are designed to profit from a drop in the underlying market or index.

Benefits of Investing in ETF

Investing in ETFs offers several benefits that can make them attractive options for various investors. Here are some key advantages:

Diversification: One of the strongest benefits of ETFs is their ability to provide instant diversification across various assets. By investing in a single ETF, you can gain exposure to a basket of stocks, bonds, or commodities, significantly reducing your risk compared to holding individual securities. This reduces the impact of any single company or asset underperforming.

Low Costs: Many ETFs boast low expense ratios, which are the annual fees charged for managing the fund. This translates to more of your returns staying in your pocket compared to actively managed mutual funds that typically have higher fees.

Transparency: Unlike mutual funds, most ETF disclose their holdings daily, offering complete transparency into what you’re invested in. This allows you to track the performance of your holdings and make informed investment decisions.

Liquidity: ETF trades throughout the day on exchanges, enabling you to buy and sell shares readily. This provides flexibility and quick access to your invested capital compared to mutual funds, which only trade once a day after market close.

Tax Efficiency: ETFs are generally considered tax-efficient due to their creation and redemption process. When investors buy or sell shares, they typically don’t trigger capital gains within the fund itself, potentially minimizing capital gains taxes for investors.

Variety and Flexibility: With thousands of ETFs available, you can find one tailored to virtually any investment strategy or sector you’re interested in. Whether you want broad exposure to the market, specific sectors like technology or healthcare, or international markets, there’s an ETF that fits your needs.

Additional Benefits:

- Passive Management: Most ETFs are passively managed, meaning they track an index instead of actively trying to outperform the market. This can be advantageous as it requires less research and analysis on your part.

- Fractional Shares: Some platforms allow you to purchase fractional shares of ETFs, making them accessible even with smaller investment amounts.

Before investing in ETF, it’s crucial to remember:

- Understand the Risks: While ETFs offer diversification, the underlying assets still carry inherent risks associated with the market or specific sectors.

- Do Your Research: Choose ETFs aligned with your investment goals, risk tolerance, and time horizon. Research the specific ETF’s holdings, expense ratio, and historical performance.

- Consider Your Portfolio: ETFs should complement your existing investments and overall asset allocation strategy.

Risks of ETF

While ETFs offer numerous advantages like diversification, low costs, and transparency, it’s essential to be aware of the potential risks before investing. Here are some key risks to consider:

Market Risk: The primary risk for all financial investments, including ETFs, is market fluctuation. The value of an ETF can go down just like any other security, depending on the performance of its underlying assets. Diversification offered by ETFs helps mitigate this risk, but it doesn’t eliminate it entirely

Tracking Error: Some ETFs aim to track a specific index but may not perfectly match its performance. This difference, known as tracking error, can arise due to various factors like fees, rebalancing practices, and market inefficiencies.

Liquidity Risk: While most ETFs are generally liquid, some less popular ones may have lower trading volume. This can lead to wider bid-ask spreads, meaning you might receive slightly less when selling or pay slightly more when buying shares compared to the published net asset value (NAV). In extreme cases, low liquidity might make it difficult to buy or sell shares quickly.

Concentration Risk: Some ETFs focus on specific sectors, industries, or themes. While they offer targeted exposure, they also concentrate risk in those areas. If the chosen sector underperforms, the ETF’s losses could be amplified compared to a more diversified option.

Tax Implications: While generally tax-efficient, capital gains taxes can still arise for individual investors when selling ETF shares, especially if the ETF has been actively traded within the fund itself. Understanding the tax implications specific to your situation is crucial.

Counterparty Risk: Most ETFs rely on market makers or authorized participants to facilitate creation and redemption of shares. If these counterparties encounter financial difficulties, it could impact the ETF’s ability to function as intended.

Expense Ratio: Although generally lower than actively managed funds, ETFs still have expense ratios, which eat into your returns. While seemingly small, the impact of fees can compound over time, so choosing ETFs with low expense ratios is important.

Closure Risk: While unlikely, there’s a chance an ETF could be closed by the issuer if it doesn’t attract enough assets or doesn’t meet profitability requirements. In such cases, investors would receive their proportionate share of the underlying assets, but it could disrupt their investment plans and potentially trigger capital gains taxes.

How to Invest in ETF?

Investing in ETFs can be a smart way to diversify your portfolio and gain exposure to different markets. Here’s a step-by-step guide to get you started:

1. Open a Brokerage Account:

This is where you’ll buy and sell your ETFs. Several online brokers offer commission-free ETF trading, so compare features and fees before choosing one. Some popular options include Fidelity, Charles Schwab, TD Ameritrade, and Vanguard.

2. Choose Your ETF:

Research and select ETFs that align with your investment goals, risk tolerance, and time horizon. Consider factors like the underlying assets, expense ratio, past performance, and tracking error. Use online screening tools and resources like ETF Database or Morningstar to explore available options.

3. Fund Your Account:

Transfer money from your bank account to your brokerage account to cover your intended investment amount.

4. Place Your Order:

Use your brokerage platform to search for the desired ETF by its ticker symbol. Specify the amount you want to invest or the number of shares you want to buy. Choose between limit orders (buy/sell at a specific price) or market orders (buy/sell at the current market price).

5. Monitor Your Investment:

Additional Tips:

- Start small: Begin with a smaller investment amount to gain experience and confidence before committing larger sums.

- Consider fractional shares: Some platforms allow buying fractional shares, making it easier to invest in expensive ETFs with limited funds.

- Automate your investments: Set up automatic deposits to your brokerage account to contribute regularly and build your portfolio over time.

- Seek professional advice: If you’re unsure about which ETFs are right for you, consider consulting a financial advisor for personalized guidance.

Here are some important reminders:

- Investing involves risks, and you could lose money.

- ETFs are not guaranteed to perform well.

- Do your own research and understand the risks before investing.

- This information is for educational purposes only and should not be considered financial advice.

Disclaimer, responsible investing requires education, planning, and continuous monitoring. By following these steps and conducting thorough research, you can make informed decisions and potentially benefit from including ETFs in your portfolio.

I hope this information is helpful for you | Read more

What is an ETF fund?

ETFs are a sort of investment fund that combines the best features of two popular assets: They combine the diversification benefits of mutual funds with the simplicity with which equities may be exchanged

How to invest in ETF?

ETF trades take place on the stock exchange where they are listed. To invest, investors must first open a trading account with a broker and also a Demat account.

ETF pay Dividends?

ETFs do pay dividends. Any dividends earned on shares held in the fund portfolio must be distributed by ETFs. As a result, ETFs pay dividends if any of the stocks in which they invest pay dividends.

should you invest in ETFs?

ETFs are a low-cost way to obtain stock market exposure. Since they are listed on an exchange and trade like stocks, they provide liquidity and real-time settlement. ETFs are a low-risk option because they duplicate a stock index, providing diversity rather than investing in a few stocks of your choosing