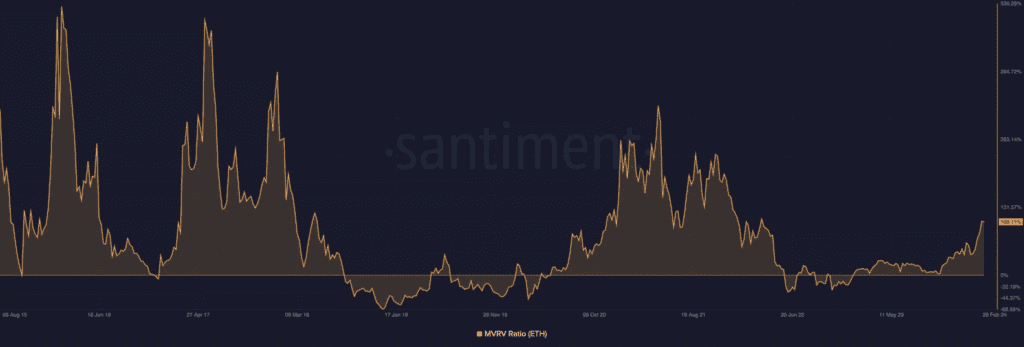

Ethereum’s MVRV ratio has reached its highest point since April 2022, according to data from Santiment.

Ethereum’s 103% MVRV ratio marks its highest in two years.

The MVRV ratio compares the current market value of an asset to the average cost at which all units were last transacted on the blockchain.

At the point when it increments, it proposes that the ongoing business sector worth of a resource is fundamentally higher than the cost at which most financial backers procure their possessions.

According to Sentiments data, as of press time, the MVRV ratio of Ethereum was 103.11%, which has risen by 145% since 25th January. This rally coincides with the recent surge in ETH’s price, which has recently surpassed the $3,400 mark, based on CoinMarketCap’s data.

The current market price of ETH is 1.03 times higher than the average price at which all ETH units were last traded on the blockchain, based on its MVRV ratio of 103%. As a result, most coin holders would see a profit of at least 100% if they sold their investments now.

Ethereum’s MVRV ratio now sits above 100%.

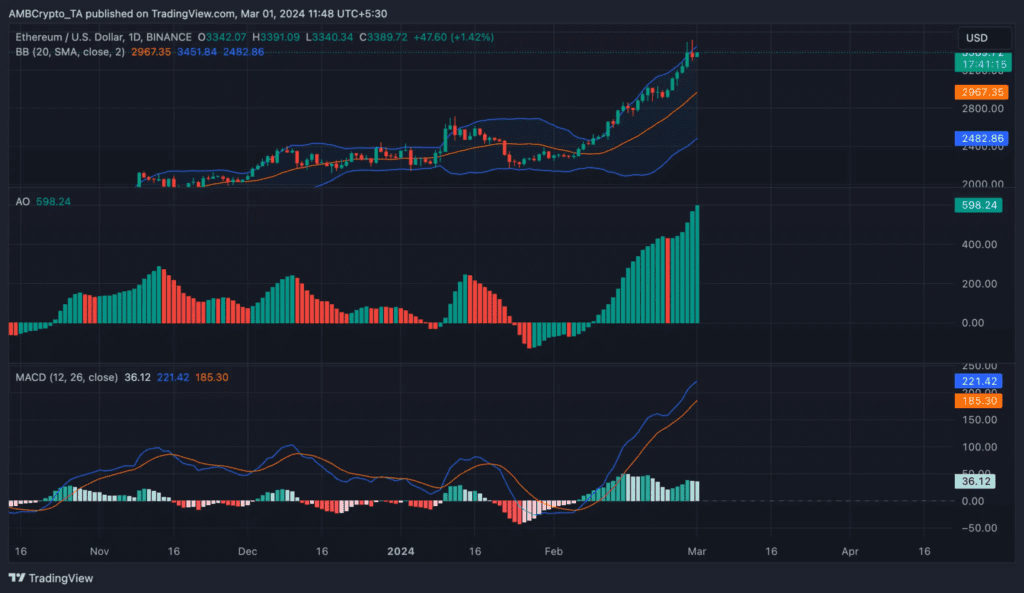

On a single-day chart, ETH’s Bollinger Bands indicator showed that ETH’s price remained prone to fluctuations. However, other key indicators indicated that bullish sentiments exceeded bearish activity.

For instance, the coin’s Amazing Oscillator returned green vertical confronting bars at press time. This pointer estimates market force by contrasting its present moment and long-haul moving midpoints.

At the point when it returns just green bars, it shows that the transient moving normal is rising quicker than the drawn-out moving normal. This recommends that the bullish opinion is solid and picking up speed.

As of this writing, the coin’s Moving Average Convergence Divergence (MACD) line was firmly above both the signal line and the zero lines and the histogram was positive.

At the point when readings from this marker show the MACD and pattern lines over nothing (similar to the case here), it proposes that the bullish force is winning on the lookout.

On the coin’s subordinates market, prospects open revenue added up to $11.38 billion as of this composition. The last time Ethereum fates open interest was that high was in December 2021, per information from Coinglass.

With the development in the coin’s positive subsidizing rates across trades, prospects merchants keep on putting down wagers at some cost rally.

Read more

Record Closes for S&P 500, Nasdaq Fueled by AI Innovation

The Coinbase Traffic 10x Surge: How Demand Overwhelmed Projections