Dive into the world of DeFi (Decentralized Finance) and understand its potential to revolutionize finance. Explore key features, functionalities, and benefits, while recognizing the inherent risks and challenges. Gain insights into this innovative movement and its impact on the future of finance.

Understanding the Rise of Decentralized Finance (DeFi) :

Generally, finance has been brought together, and represented by foundations like banks, go-betweens, and administrative bodies. DeFi challenges this standard by utilizing blockchain innovation to make an open, straightforward, decentralized monetary biological system. It offers a range of monetary administrations — loaning, getting, exchanging, and that’s just the beginning — without the requirement for go-betweens. At its center, DeFi plans to give open and permissionless admittance to monetary devices, empowering anybody with a web association to take part in a borderless monetary biological system.

Here’s a breakdown of its key aspects:

Core features:

- Decentralization: No single entity controls the network, empowering individuals to interact with each other without intermediaries directly.

- Transparency: All transactions are recorded on a public blockchain, ensuring verifiable and auditable financial activity.

- Accessibility: Anyone with an internet connection can participate, regardless of geographical location or financial background.

- Innovation: Developers are constantly creating new DeFi applications, expanding the range of available financial products and services.

Key functionalities:

- Borrowing and Lending: Earn interest by lending your crypto assets or borrowing funds against them without relying on banks.

- Trading: Decentralized exchanges allow for peer-to-peer trading of cryptocurrencies and other digital assets.

- Savings: Earn interest on your idle crypto through various DeFi protocols.

- Insurance: Purchase decentralized Finance insurance against hacks, smart contract vulnerabilities, and other potential risks.

- Derivatives: Access a variety of derivative products like options and futures contracts within the DeFi ecosystem.

Significance of DeFi Foundation to Open Monetary Consideration

The customary monetary framework, set apart by eliteness, failures, and imposing hindrances to section, is going through an extraordinary shift with the ascent of Decentralized Money (DeFi). DeFi addresses a change in perspective towards monetary inclusivity, engaging people overall to partake in loaning, getting, and exchanging, from there, the sky is the limit, without reliance on ordinary financial foundations.

To completely get a handle on the meaning of DeFi, perceiving the squeezing difficulties inborn in the current monetary landscape is pivotal.

| Aspect | DeFi | Traditional Finance |

|---|---|---|

| Global Accessibility | DeFi is globally accessible without geographical restrictions. | The services may have limited accessibility based on location and local regulations. |

| Inclusion of the Unbanked | Provides an opportunity for the unbanked population to access financial services. | This may exclude those without a banking history or access to traditional banking services. |

| Interoperability | DeFi platforms can be interoperable, allowing different protocols to work together. | The systems may lack interoperability, leading to isolated financial services. |

| Smart Contracts | DeFi relies on smart contracts for automated and programmable financial agreements. | It typically involves manual contract execution and intermediaries. |

| Permissionless Innovation | DeFi allows for permissionless innovation, enabling developers to create new protocols and applications without seeking approval. | It often requires regulatory compliance and approval for new financial products or services. |

| Collateral and Lending | DeFi enables users to leverage their crypto assets as collateral for loans without traditional credit checks. | Traditional lending often involves complex credit checks and collateral from conventional assets. |

| Counterparty Risks | DeFi aims to minimize counterparty risks through decentralized protocols. | It involves counterparty risks, especially in complex financial transactions. |

| Costs and Fees | DeFi transactions may have lower fees due to reduced intermediary involvement. | The transactions can involve multiple intermediaries, leading to higher transaction costs. |

| Regulatory Oversight | DeFi operates in a relatively decentralized and often less regulated environment. | It is subject to extensive regulatory oversight, varying by jurisdiction. |

The Rise of DeFi in Conventional Money

Decentralized Finance (DeFi) has emerged as a disruptive force in the financial landscape, challenging the traditional model dominated by centralized institutions. It leverages blockchain technology to create peer-to-peer financial networks, potentially bypassing intermediaries and offering new opportunities for individuals and businesses.

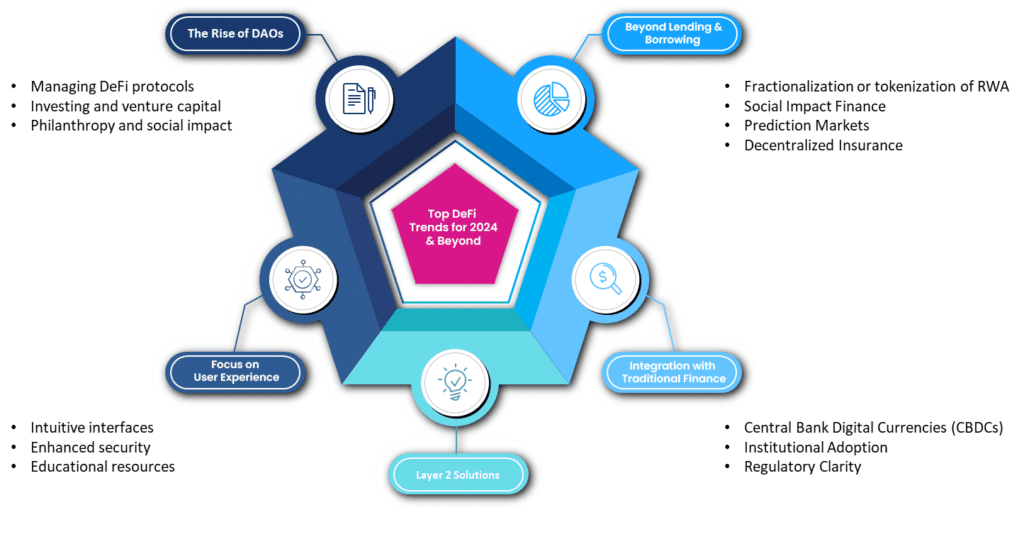

Top DeFi Trends for 2024, and Beyond

The year 2024 is set to be a milestone period for DeFi as crypto winter defrosts and a few patterns have arrived at their regular development focuses. According to Innova specialists, this is what 2024 holds for decentralized finance.

- Past Loaning and Getting: While DeFi at first built up momentum for its Shared (P2P) loaning and acquiring stages, 2024 will see an expansion of utilizations. We hope to see developments in:

- Fractionalization or tokenization of RWA: Democratizing admittance to high-esteem resources like land and craftsmanship through tokenized proprietorship.

- Expectation Markets: Saddling aggregate insight to anticipate certifiable occasions and set out new speculation open doors.

- Decentralized Insurance: Offering adaptable and reasonable inclusion choices based on brilliant policies.

- Social Effect Money: Empowering straightforward and productive raising support for social causes like sustainable power projects.

2. Mix with Customary Money: The walls between DeFi and conventional money are disintegrating. 2024 will observe further incorporation through:

- Central Bank Digital Currencies (CBDCs): Integration of CBDCs with DeFi protocols can streamline cross-border payments and unlock new financial products.

- Institutional Adoption: Traditional financial institutions are exploring DeFi products and services, offering their clients access to this burgeoning ecosystem.

- Regulatory Clarity: As regulators gain a better understanding of DeFi, clearer guidelines can foster responsible innovation and attract larger players.

3. Layer 2 Arrangements: Versatility remains an obstacle for DeFi. In 2024, we expect expanded reception of Layer 2 arrangements like scaling chains, sidechains, and hopeful rollups to further develop exchange speed and lessen expenses.

4. Center around Client Experience: Complex points of interaction and security chances have upset DeFi reception. 2024 will see an emphasis on further developing client experience through:

- Natural points of interaction: Improving on DeFi conventions and incorporating them with recognizable monetary devices.

- Upgraded security: Strong safety efforts and further developed risk the board instruments will assemble trust and draw in new clients.

- Instructive assets: Far-reaching instructive drives will engage clients to explore the DeFi scene securely and certainly.

5. The Rise of DAOs: Decentralized Independent Associations (DAOs) are rising as incredible assets for local area-driven administration and gathering pledges. In 2024, anticipate that DAOs should assume a greater part in

- Overseeing DeFi conventions: DAOs can guarantee fair and straightforward administration of DeFi projects.

- Financial planning and funding: DAOs can pool reserves and put resources into promising DeFi new businesses.

- Generosity and social effect: DAOs can work with local area-driven drives for social greatness.

Innova’s Contribution

The excursion of DeFi is an account of strength, versatility, and a constant quest for a decentralized monetary future. Innova Arrangements is at the bleeding edge of giving circulated finance advances that can change banking tasks. Our contributions adjust flawlessly with the critical patterns and difficulties faced by the decentralized monetary biological system.

Digital Assets

- Innova’s blockchain-based solutions enhance transparency by converting traditional assets into digital tokens. This streamlines settlements and significantly reduces asset management costs, contributing to the efficiency of the DeFi space.

Digital Currency

- General admission and member discounts for two adults

- Four free tickets per special exhibition

- Four single-use guest passes per year

Cross-Border Payments

DeFi’s global accessibility is one of its defining features. Innova’s cross-border payment solutions provide ease of use, speed, cost-effectiveness, and enhanced security. This helps mitigate high fees, time delays, and security risks in transactions.

Loyalty and Rewards Using Blockchain

Innova’s blockchain-based loyalty and rewards solutions offer superior performance by guaranteeing security, transparency, efficiency, and personalized services. This aligns with the broader trend in DeFi where improving user experience is paramount for widespread adoption.

Demystifying the Decentralization:

At its core, DeFi stands for the disintermediation of traditional financial services. Instead of relying on centralized institutions like banks, DeFi leverages blockchain technology to create peer-to-peer financial protocols. Think of it as a financial system built on transparent, public ledgers, where individuals directly connect to borrow, lend, trade, and invest without intermediaries.

Unveiling the Opportunities:

DeFi unlocks a plethora of innovative opportunities:

- Financial Inclusion: Anyone with an internet connection can participate, regardless of geography or financial status, promoting global financial accessibility.

- Enhanced Transparency: Transactions are recorded on public blockchains, fostering trust and accountability through verifiable financial activity.

- Unprecedented Innovation: Developers are constantly creating new DeFi applications, pushing the boundaries of financial products and services, from decentralized lending platforms to prediction markets.

Navigating the Risks:

While DeFi boasts potential, it’s crucial to acknowledge its inherent risks:

- Volatility: Crypto assets underpinning DeFi are notoriously volatile, and DeFi protocols built upon them can amplify this volatility, exposing users to potential losses.

- Security Vulnerabilities: Smart contracts and DeFi platforms are attractive targets for hackers, and exploits can lead to significant financial losses.

- Regulatory Uncertainty: The legal landscape surrounding DeFi is still evolving, creating uncertainty for users and developers, and potentially hindering mass adoption.

The Road Ahead:

Despite the challenges, the potential of DeFi cannot be ignored. Governments and institutions are actively exploring its possibilities, and major corporations are gradually dipping their toes into the DeFi waters. Regulatory clarity and technological advancements are key to addressing existing concerns and unlocking DeFi’s full potential.

Understanding DeFi is not just about the technology, but about understanding the paradigm shift it represents. It’s about a future where individuals have greater control over their finances, and innovation thrives in a transparent and accessible ecosystem. Whether you choose to actively participate or simply observe, DeFi’s journey promises to be a fascinating one, with profound implications for the future of finance.

This article is just a starting point for your exploration of DeFi. Feel free to:

- Explore specific DeFi applications like Compound, Aave, or Uniswap to understand their functionalities and potential.

- Research the latest developments in the DeFi space, including regulatory updates and technological advancements.

- Engage in discussions and communities around DeFi to learn from experienced users and developers.

- Remember, always do your own research before investing in any financial products, including DeFi.