CrowdStrike Stock Soars Following Stellar Earnings and Optimistic Outlook

CrowdStrike, a leading cybersecurity company, recently made headlines as its stock price surged nearly 24% in extended-hours trading. This significant increase came on the heels of the company’s impressive quarterly performance and an upbeat outlook for both the current quarter and the full year.

CrowdStrike Stock – Strong Quarterly Performance

Reported adjusted earnings of 95 cents per share for the period ending January 31, comfortably surpassing analysts’ forecast of 82 cents a share. Revenue for the period reached $845 million, marking a 33% increase from the previous year and slightly exceeding the consensus view of $839 million.

KEY TAKEAWAYS

- CrowdStrike shares surged nearly 24% in extended-hours trading Tuesday after the company surpassed quarterly estimates and provided better-than-expected current-quarter and full-year guidance.

- The company also announced it has agreed to acquire Flow Security in a cash and stock deal to bolster its cloud data protection.

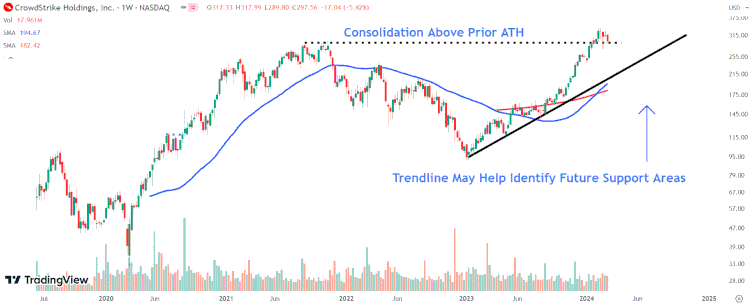

- An uptrend line on the CrowdStrike chart connecting several swing lows over the past 14 months may help identify key support areas during future retracements.

Upbeat Outlook

Looking ahead, CrowdStrike guided for the current quarter that exceeded Wall Street’s expectations. The company projected adjusted earnings per share to range between 89 cents and 90 cents, with revenue expected to fall between $902 million and $906 million. These projections beat Wall Street’s forecasts of 82 cents in adjusted earnings and sales of $899 million.

For the full fiscal year 2025, anticipates earnings to range between $3.77 and $3.97 per share on revenues of $3.925 billion to $3.989 billion. Analysts had been expecting $3.76 per share on sales of $3.938 billion.

Acquisition of Flow Security

In addition to its financial results, CrowdStrike announced its agreement to acquire Flow Security in a cash and stock deal. This acquisition aims to bolster CrowdStrike’s cloud data protection capabilities.

Key Indicators to Watch

Investors should keep an eye on the trendline linking several swing lows over the past 14 months. This trendline may help identify key support areas during future retracements.

Conclusion

CrowdStrike’s strong performance and optimistic outlook underscore the company’s robust growth prospects. The acquisition of Flow Security further enhances its capabilities, positioning it well for future success. As the cybersecurity landscape continues to evolve, CrowdStrike appears poised to capitalize on emerging opportunities.

Source:

Read more.

Deutsche Börse Launch Crypto Trading Platform DBDX

Hong Kong: Setting Standard for Web3 and Digital

Ethereum 101: A Beginner’s Guide to the Revolutionary Blockchain Technology

Disclaimer: This blog post is for informational purposes only and should not be taken as financial advice. Always conduct your own research or consult with a financial advisor before making investment decisions.